S&P 500 and Nasdaq Retreat while Bitcoin Nears New Peaks

- 05 March 2024 2:01 AM

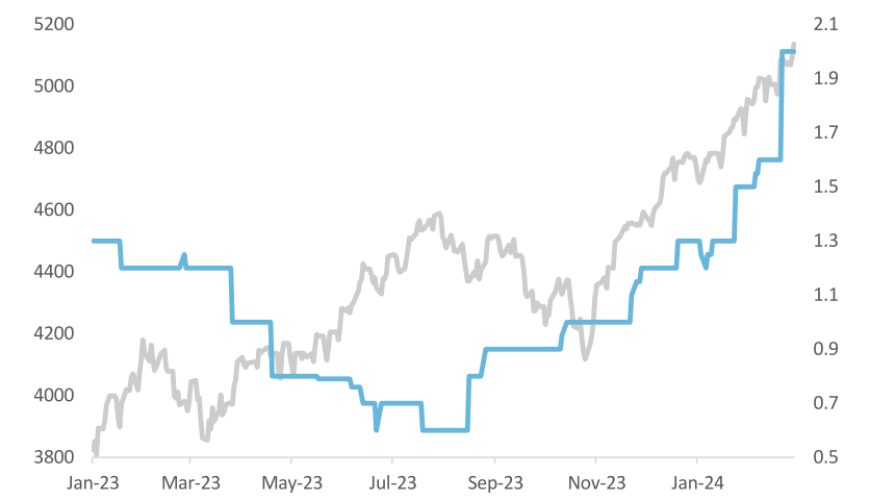

Today’s financial market noticed an interesting flux as the Standard & Poor's 500 Index (S&P 500) and Nasdaq took a step back from their record highs. Yet, offsetting this downward trend, Bitcoin, the popular cryptocurrency, has continued its unrelenting march towards new elevating prices.

The S&P 500, Nasdaq, and Bitcoin, along with other key indices and finance indicators, tend to trend the economic health of not just the US, but the global market fabric. A statistical composite of 500 of the largest publicly traded companies in the U.S., the S&P 500, in particular, is considered a prime barometer of U.S. equities.

As per the latest turn of events, the S&P 500 and Nasdaq have experienced a retreat. While not an alarming drop, this retreat indicates that investors may be feeling cautious. The market trends witnessed today in the S&P 500 and Nasdaq have been playing off the back of mixed signals from global markets, continued COVID-19 impacts, and geopolitical tensions.

S&P 500 being a market capitalization-weighted index gives a broad snapshot of the overall U.S. equities market. Hence, its retreating indicates a cautiousness among investors due to recent developments. Likewise, Nasdaq; an index heavily influenced by the technology sector, has also experienced a similar pullback.

Contrary to these receding trends, Bitcoin seems unstoppable in its rise. In recent years, cryptocurrencies, especially Bitcoin, have seen a surge in interest among investors and corporations alike. Marking its presence in the investment world, Bitcoin has been showing potential signs as an emerging asset class.

As an asset immune to the traditional economic impacts such as inflation, Bitcoin is nudging closer to new records. This solid performance signifies investors' willingness to trust this immersive digital currency, as it continues to burgeon. Its rising popularity can be attributed to its potentially high returns, decentralized nature, and growing acceptance as a mode of payment by several high-profile companies.

Investors have increasingly seen Bitcoin as a store of value and a hedge against economic downturns and inflation. This positive sentiment is a primary factor driving the demand for the cryptocurrency. With the COVID-19 pandemic bringing global economies to a standstill, Bitcoin has recently been seen as a 'digital gold', a buffer against economic uncertainties.

The retreat of the S&P 500 and Nasdaq marks a shift in investors' action. It reflects uncertainties in conventional markets stemming from the geopolitical landscape and the COVID-19 pandemic aftermath. On the other hand, the continued rise in the price of Bitcoin suggests investors' heightened confidence in this digital asset, emphasizing its resilience amidst the global economic turmoil.

Despite the retreat of S&P 500 and Nasdaq, the market, in general, is not in tumult. On the contrary, market experts believe it's just a part of the market's natural ebb and flow. Meanwhile, the rise of Bitcoin continues to add a new twist to the financial canvas and offers investors a new avenue to explore.

Heading into the future, these shifts underline the importance of diversified portfolios for investors. The financial market remains a mixed bag of opportunities and challenges which reinforces the notion that smart investing involves diversification across the range of traditional assets and emerging digital currencies.