Brian Sozzi

Stock market today: Stocks sink, yields jump after inflation data torpedoes rate-cut hopes

Contents

- Best watch the dollar after the CPI report, too

- Delta beats Q1 earnings expectations, CEO sees 'quite healthy' travel demand

- Stocks slide at the open

- Inflation hotter than expected in March

- If companies are clamping down on spending ahead of the election ...

- Nvidia weakness persists

- Date save for crypto investing fans

- Here’s a markets stat to get your day started right

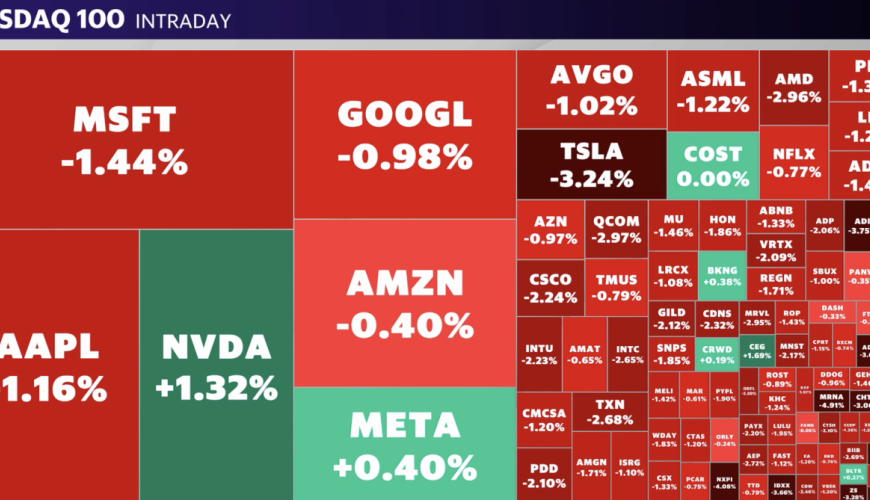

US stocks stumbled on Wednesday after a key inflation report showed an unexpected uptick in consumer prices last month.

The Dow Jones Industrial Average (^DJI) fell about 1.1%, or almost 425 points. The S&P 500 (^GSPC) dropped nearly 1%, and the tech-heavy Nasdaq Composite (^IXIC) lost almost 0.9%.

Meanwhile, bond yields soared. The 10-year Treasury yield (^TNX) gained as much as 20 basis points on Wednesday afternoon, hitting nearly 4.57%, its highest level since November.

The moves came after government data showed the Consumer Price Index (CPI) rose 0.4% over the previous month and 3.5% over the prior year in March, an unexpected acceleration from February's 3.2% annual gain in prices.

Both measures came in ahead of economist forecasts of a 0.3% month-over-month increase and a 3.4% annual increase, according to a survey by Bloomberg.

The hotter-than-expected print could prompt investors to expect fewer rate cuts from the Fed this year. Indeed, according to the CME FedWatch tool, around 80% of bets are now on the Fed holding steady at current rate levels in June. More than half of investors also expect the central bank to leave the rate unchanged through its July meeting, leaving September as the most likely spot for an initial cut from the US central bank.

Also out Wednesday, the latest minutes from the Federal Reserve's latest policy meeting showed "almost all" officials believed it would be appropriate to lower interest rates "at some point."

Meanwhile, crude oil futures erased earlier losses in afternoon trading following a report that the US and its allies believe a strike by Iran or its proxies against Israeli targets is imminent. West Texas Intermediate (CL=F) rose more than 1% back above $86 per barrel, while Brent (BZ=F) futures jumped to hover above $90 per barrel.

Shelter costs accounted for 60% of March’s overall monthly gain in core CPI, which doesn't include food and energy, according to the BLS.

Some Wall Street economists expect the shelter component of CPI to bottom out by spring or summer of next year based on how sticky the number has remained.

Read more here.