The inverted yield curve and the Leading Economic Index have failed as recession predictors

Stocks made new record highs, with the S&P 500 setting an intraday high of 5,261.10 and a closing high of 5,241.53 on Thursday. For the week, the S&P increased 2.3% to close at 5,234.18. The index is now up 9.7% year to date and up 46.3% from its October 12, 2022 closing low of 3,577.03.

Just because something happens much of the time doesn’t mean it happens all of the time. This is true for the stock market, the economy, and probably everything else in our lives.

In recent years, we’ve learned this is true of two of the most popular and historically consistent recession indicators: the yield curve and the Conference Board’s Leading Economic Index.

The inverted yield curve

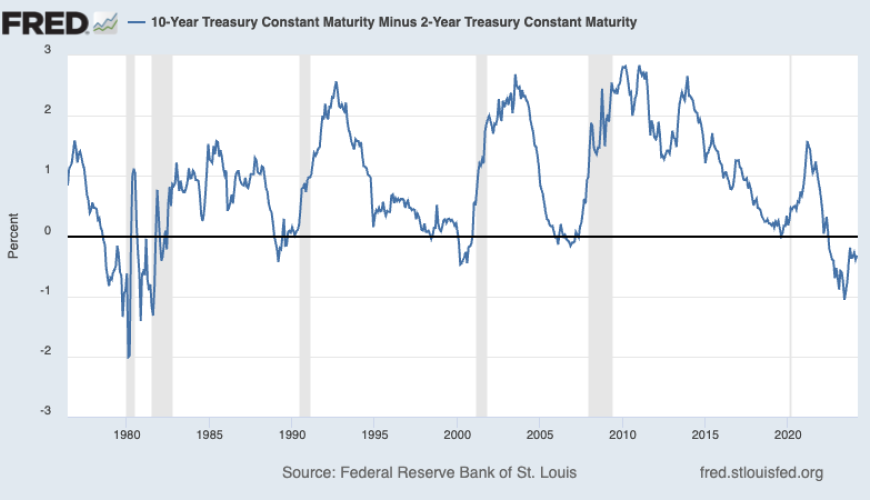

The yield curve represents the shape that forms on a chart when you plot the interest rate, or yield, for Treasury debt securities with various maturities. Typically, shorter-term rates like the yield on the 2-year Treasury note will be lower than the yield on the 10-year Treasury note.

The yield curve inverts when a longer term rate is lower than a shorter term rate (e.g., when the yield on the 10-year note is lower than yield on the 2-year note).

Historically, when the yield on the 10-year note falls below the yield on the 2-year note (i.e., when the “2s10s” yield curve inverts), recessions have been somewhat soon to follow.

Two years ago, the 2s10s yield curve inverted, which emboldened economists who were warning of an impending recession.

We’re still waiting for that recession.

Deutsche Bank’s Jim Reid noted that on Wednesday "we passed the longest continuous U.S. 2s10s inversion in history. Although the 2s10s first inverted at the end of March 2022, it has now been continuously inverted for 625 days since July 5th 2022. That exceeds the 624 day inversion from August 1978, which previously held the record."

While the inverted yield curve may have a good track record of predicting recessions, it’s not very precise in predicting when recessions will start. According to a Goldman Sachs analysis of 2s10s inversions since 1965, seven to 49 months passed before recessions occurred, with a median of 20 months.

So, the economy could go into recession a week, a month, or a year from now, which would arguably confirm the inverted yield curve’s signal.

That said, one has to question the value of an indicator that sometimes leads events by two to four years.

As Oaktree Capital’s Howard Marks says, "Being too far ahead of your time is indistinguishable from being wrong."